He was a teen star with everything—fame, fortune, and a hit TV show. But just as his career reached new heights, he made a surprising decision. He stepped away from Hollywood, choosing a life path few had expected.

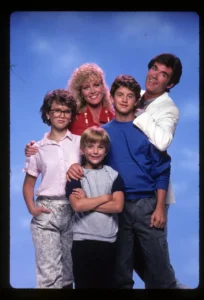

As a beloved child actor on “Growing Pains,” he became one of the most popular young stars of the 1980s. Teen magazines put him on their covers, and fans adored him. However, behind the fame, he struggled with the feeling that Hollywood wasn’t where he was meant to be.

At the height of his fame in the early 1990s, this actor made a choice that surprised many. He turned away from acting and embraced a life of faith. This decision didn’t just change his career; it changed his entire worldview. What happened to him after he left Hollywood?

From Childhood Dreams to Unexpected Stardom

As a child, he didn’t dream of becoming an actor. He wanted to be a doctor. But when his mother, urged by a friend, introduced him to acting, his career path shifted. That friend was the mother of Adam Rich, a famous child actor. She suggested his mother take him to an agent to try his luck with commercials.

Though he wasn’t eager, his mother followed the advice, and by age nine, he was landing small roles. One of his first jobs was a commercial for McDonald’s. Despite his early success, he didn’t enjoy acting much.

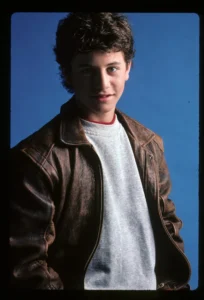

He once said, “I was always annoyed having to brush my hair and tuck my shirt in to go audition.” Still, his career took off, and he became famous for his role as Mike Seaver on Growing Pains. But despite the fame, he felt something was missing.

From Atheism to Christianity

He grew up in a non-religious household. “We didn’t go to church,” he said. He considered himself an atheist by his mid-teens, influenced by teachers who dismissed religion as a fairy tale. At the time, he was focused on his acting career and had no interest in faith.

However, his life took a turn when he attended church with a girl he liked. “I went to church not because I was interested in God, but because I was interested in the girl,” he admitted. That casual decision eventually led him to embrace Christianity.

Hollywood’s Response

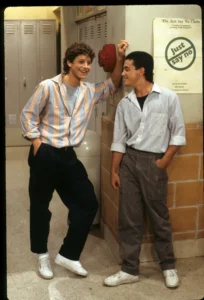

By age 17, his newfound faith began to impact his work on Growing Pains. The show’s producers and cast grew concerned about how his religious beliefs might affect the show. His co-workers worried that his changing priorities could put the show’s future in jeopardy.

Reflecting on those years, he said, “I was trying to take the moral high road, but sometimes I didn’t handle it as gracefully as I should have.” His commitment to his faith, however, remained strong.

The Dark Side of Hollywood

As his faith deepened, he became more aware of unsettling behaviors in Hollywood. “The evil, the darkness of Hollywood has been going on for a long time,” he said. He described troubling experiences behind the scenes during his time on Growing Pains.

One shocking event involved his dialogue coach from the show, Brian Peck, who was later convicted of sexual abuse. These incidents solidified his decision to step away from the industry.

Life After Hollywood

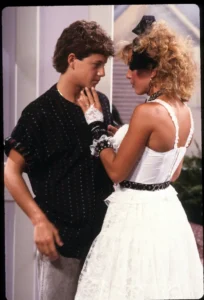

At 20, he married his Growing Pains co-star, Chelsea Noble, and they built a family-focused life together. The couple adopted four of their six children, a cause close to both of their hearts. Noble herself was adopted, and they helped their children connect with their biological families when the time was right.

Cameron’s dedication to his family and his faith became evident during the filming of Fireproof in 2008. He refused to kiss anyone other than his wife in a scene, so the filmmakers dressed Noble as the female lead for the shot.

Leaving California

In 2021, Cameron decided to leave California. He shared on social media that Tennessee, Florida, and Texas were top suggestions for a new home. Ultimately, he chose Tennessee for its slower pace and “wholesome values.” Three of his children already lived there, making the move even more appealing.

In Tennessee, Cameron found a community of like-minded people, including others who had left Hollywood. He appreciated the “healthy freedom mindset” and found Tennessee to be a hub for Christian projects.

Becoming a Grandfather and New Projects

In July 2024, Cameron and Noble welcomed their first grandchild, Maya Jeanne Noble Bower. He shared the joyful news online, expressing his excitement for this new chapter as grandparents.

Cameron continued his work on faith-based projects, including the 2022 film Lifemark, which explores adoption and the value of life—a topic close to his heart as both a father of adopted children and the husband of an adopted woman.

Today, Cameron remains committed to creating media that reflects his beliefs. Though his teenage heartthrob days are behind him, his journey has brought him deep fulfillment and purpose.

How to Own Your Dream Home

For most people, their first home isn’t their dream home. It starts off nice enough. But as time goes by and your family grows, starter homes tend to get a little . . . cramped.

But don’t hate on your current home too much. Because while it gave you a safe and dry place to lay your head at night, it was also setting you up to own your dream home someday.

We’ll show you how it all works and walk you through the steps that’ll get you in your dream home—one you can actually afford!

How to Get Your Dream Home in 5 Steps

Here are the steps:

- Follow the Financial Basics

- Find Out How Much Equity You Have

- Set Your New Home-Buying Budget

- Find the Right Dream Home for You

- Be Picky and Patient

Now let’s cover each step in more detail.

Step 1: Follow the Financial Basics

First thing’s first—you have to get out of debt, get on a budget, and build up an emergency fund of 3–6 months of expenses. Sounds pretty basic, right? If you haven’t completed these steps, then you’re not ready to upgrade to your dream home . . . yet.

Now, when you’ve got house fever, it can be hard to focus on paying off debt or saving an emergency fund before you upgrade your home—especially when you’re feeling the pressure of rising home prices and interest rates.

But whether it’s your second or third house, you should only buy a home when you’ve covered the financial basics we mentioned above. Then you’ll be ready to start the journey toward owning your dream house.

And that journey starts with your home equity. What’s equity? Well, we’re glad you asked . . . that brings us to the next step.

Step 2: Find Out How Much Equity You Have

Home equity is a pretty simple concept: It’s your current home’s value minus whatever you still owe on your mortgage.

See, in most cases, your home’s value increases over time. Similar to other long-term investments (like retirement accounts), homes gradually increase in value. There have been periods of ups and downs in the market to be sure, but the value of real estate has consistently gone up. According to the St. Louis Federal Reserve, the average sale price of a home has increased over 2,300% from 1965 to 2023! And in the last ten years (2013 to 2023), there’s been a 68% increase.1 As your home increases in value, so does your equity. In real estate terms, this is called appreciation.

Other factors that increase your home’s equity include:

- Added value: Home improvement projects like adding square footage, updating fixtures and appliances, or even just slapping on a new coat of paint can add value to your home.

- Mortgage paydown: Paying down your mortgage not only gets you out of debt faster, it also builds your equity. The less you owe on your home, the more equity you have.

The amount of equity you have gives you a pretty good idea of how much money you’ll end up with after selling your house. You can use that money to make a hefty down payment and cover the other costs that come with buying a home.![]()

Find expert agents to help you buy your home.

So, how do you determine your home’s value? Well, you can get a ballpark estimate on real estate websites like Zillow, ask a trusted real estate agent to perform a competitive market analysis (which they’ll do anyway if they’re helping you sell your house), or get a professional appraisal.

Finding out your home’s equity will involve a little math, but it’s third-grade-level stuff, so don’t sweat it.

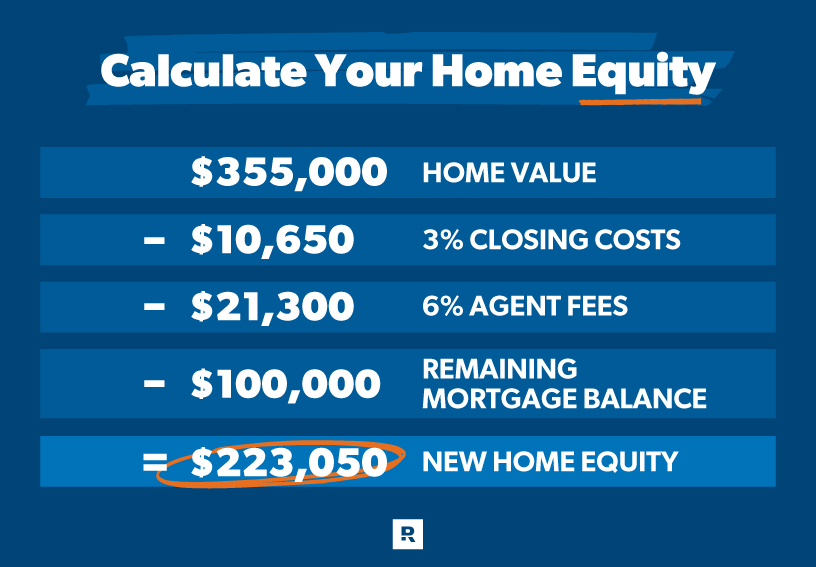

Here’s what we mean. Let’s say your home’s current value is $355,000. When you sell that house, you’ll have to pay for between 1–3% of the sale price in closing costs, another 6% in fees for the real estate agent who helped you sell it, and whatever’s left to pay off on your mortgage.

That means you can estimate clearing over $223,000 from selling your house. That’s a killer down payment on your dream home! And if your home is paid off, that’s even more money to put down and use to pay for things like repairs and moving expenses.

Step 3: Set Your Dream Home Budget

Once you know how much you’ll clear from the sale of your home, you can start making a budget for your dream home.

The key to owning your dream home (instead of it owning you) is to keep your mortgage payment to no more than 25% of your take-home pay on a 15-year fixed-rate mortgage, along with paying a down payment of at least 20% to avoid private mortgage insurance (PMI). Never get a 30-year mortgage even if the bank offers it (and they will). You’d pay a fortune in interest—money that should go toward building your wealth, not the bank’s.

So, let’s say your take-home pay is $4,800 a month. That means your monthly mortgage payment shouldn’t be any bigger than $1,200. By the way, that 25% figure should also include other home fees collected every month with the mortgage payment like homeowners association (HOA) fees, insurance premiums and property taxes.

Plug your numbers into our mortgage calculator to see how much house you can afford.

And don’t forget to budget for all those other costs that come with the home-buying process in addition to your closing fees—things like moving expenses and any upgrades or repairs you might need to make. You don’t want these hidden costs to catch you off guard or drain your emergency fund.

Step 4: Find the Right Dream Home for You

This is where things get real. After all your hard work building up your equity (and doing a lot of math—don’t forget that), you’re finally ready to start the house hunt. Woo-hoo!

But don’t lose focus. Stay zoned in by making a list of features that make a home fit your budget, lifestyle and dreams—and stick to it throughout your house hunt. Here are a few ideas to get you started.

- Don’t compromise on location and layout. If you plan to be in this home for the long haul, an out-of-the-way neighborhood or a wacky floor plan is a deal breaker. Look for a community and layout that’ll suit your lifestyle now and for years to come.

- Think about how much space your family needs. While your budget has the final say about how much home you buy, you’ll want your dream home to fit your family’s needs through different life seasons.

- Consider the school districts. If you have or want kids, the quality of the nearby school districts is probably already on your mind. But even if you don’t have kids or you’re retired, keep in mind that having good schools nearby could increase your home’s value.

- Look for a house that’ll grow in value. Are home values rising in the area? Is the number of businesses going up? These factors can help you figure out whether your dream home will turn into a good investment.

- Count the costs. Want that fancy master bathroom with the multiple showerheads and the Jacuzzi tub? Be clear on what’s a must-have and what’s nice to have. And don’t forget, upgraded features like that will make your dream home more expensive.

Step 5: Be Picky and Patient

We know you’re anxious to get into those new digs, but be patient. Wait for the right house at the right time. Don’t spend your money on a less-than-ideal home just because you’re tired of looking.

The key is finding a good real estate agent who understands your budget and refuses to settle for “good enough.” They’re as committed to your dream as you are and will have your back throughout the entire process, no matter what it takes.

In addition to teaming up with a great real estate agent, you can take a couple of extra steps to make sure you’re ready to strike as soon as the right home comes up:

- Get preapproved for a 15-year fixed-rate mortgage. Having preapproved financing is a green flag for sellers—especially in multiple offer situations. And because this puts most of your information in the lender’s system, you’ll be on the fast track to closing once your offer is accepted.

- Offer earnest money with your bid. Earnest money is a deposit to show you’re truly interested in a home. Usually it’s 1–2% of the home’s purchase price and it’s applied to your down payment or closing costs. Even if the deal falls through, you can almost always get most of it back.

Find a Real Estate Expert in Your Local Market

Now, you might be thinking you have some work to do before you’re ready to find your dream home. Or you may be realizing your years of hard work are about to pay off! Regardless, if you follow these steps, you’ll find the house you’ve always wanted and avoid a purchase you’ll regret.

Once you’re ready, connect with one of our RamseyTrusted real estate agents. These are high-performing agents who do business the Ramsey way and share your values so you can rest easy knowing the search for your dream home is in the right hands.

Find the only real estate agents in your area we trust, and start the hunt for your dream home!

Leave a Reply